Contents:

Adjustments propose by current year auditors might also affect the opening balances. It depends on the nature of the adjustment, and if the adjustment is made, it affects the opening balance. Some of them might affect the opening balance of retained earnings. You can find this number by subtracting your company’s total expenses from its total revenue for the period. It tells you how much profit the company has made or lost within the established date range. That’s why you must carefully consider how best to use your company’s retained earnings.

A growing business might decide to utilize retained earnings to finance growth while reducing debt simultaneously. Add this retained earnings figure of $7,000 to the Q3 balance sheet in the retained earnings section under the equity section. This helps investors in particular get a snapshot view of the profitability of a business. Usually, the retained earnings statement is very simple and shows the calculations as described below in the next section.

Also well versed in internal and external policy document and manual creation. By evaluating other business areas, you can begin to identify where net income may be affected and how your bottom line ultimately affects your RE amount. This articledefines negative retained earnings and how they can impact a company.

KBRA Publishes Rating Report for Bain Capital Specialty Finance, Inc. – Yahoo Finance

KBRA Publishes Rating Report for Bain Capital Specialty Finance, Inc..

Posted: Mon, 17 Apr 2023 23:08:00 GMT [source]

Despite the role the board is supposed to play in guarding the shareholders’ interests, owners of stock in large, mature companies are fundamentally estranged from them and powerless to change them. So they do not benefit when somebody chooses to “invest” in their stock. Of course, even the company cannot call its earnings “cash.” Before arriving at cash flow, a company must separate from its profits adjustments like depreciation and capital expenditures.

Starting a Business

Cash dividends reduce the amount of the company’s cash account, and as such reduce asset value of the company’s balance sheet. Stock payments are not cash items and therefore do not affect cash outflow but do reallocate the portion of retained earnings to common stock and additional paid-in capital accounts. When a company issues common stock to raise capital, the proceeds from the sale of that stock become part of its total shareholders’ equity but do not affect retained earnings. However, common stock can impact a company’s retained earnings any time dividends are issued to stockholders.

On a sole proprietorship’s balance sheet and accounting equation, Owner’s Equity on one of three main components. Owner’s Equity is the owner’s investment in their own business minus the owner’s withdrawals from the business plus net income since the business began. In a corporation, the earnings of a company are kept or retained and are not paid directly to owners. In a sole proprietorship, the earnings are immediately available to the business owner unless the owner decides to keep the money for the business. The accountant will also consider any changes in the company’s net assets that are not included in profits or losses (i.e., adjustments for depreciation and other non-cash items).

What Are the Two Categories of Profit and Loss Accounts?

RE offers internally generated capital to finance projects, allowing for efficient value creation by profitable companies. Over the same duration, its stock price rose by $84 ($112 – $28) per share. For an analyst, the absolute figure of retained earnings during a particular quarter or year may not provide any meaningful insight.

As a result, the firm will be less able to pay a dividend than before the purchase was accomplished. To naïve investors who think the appropriation established a fund of cash, this second entry will produce an apparent increase in RE and an apparent improved ability to pay a dividend. A company’s management team always makes careful and judicious decisions when it comes to dividends and retained earnings. During the same period, the total earnings per share was $13.61, while the total dividend paid out by the company was $3.38 per share.

This investor bought stock oblivious of market timing, collected dividends for five years, and sold at a set point in the fifth year. To ensure this “blindness,” Lane Birch and I averaged the high and low prices for the years of purchase and sale. So total shareholder enrichment becomes the sum of paid dividends over five years plus the change in the stock’s market value. Since we compared the companies over the same periods, we didn’t need to correct for inflation or discount rates. Retained Earnings is a term used to describe the historical profits of a business that have not been paid out in dividends.

Drive Business Performance With Datarails

If a fob shipping point starts the year with $1 million in retained earnings, has a net income of $1 million, and pays out $200,000 in dividends, its new retained earnings figure would be $1.8 million. Finance, a statement of retained earnings explains changes in the retained earnings balance between accounting periods. Retained earnings appear on the company’s balance sheet, located under the shareholder equity (aka stockholders’ equity or owner equity) section.

In this guide we’ll walk you through the financial statements every small business owner should understand and explain the accounting formulas you should know. Some benefits of reinvesting in retained earnings include increased growth potential and improved profitability. Reinvesting profits back into the business can help it expand and become more successful over time. The main task of retained earnings is to improve the company’s fundamentals in the long term . But the ROCE and EPS have shown negative growth rates in the same period. So, as an investor, I will look at a better investment alternative.

You can find the dividend payout ratio by subtracting the retention ratio in decimal form from one. From retained earnings, the investors can analyze how much money is reinvested in the business, which may lead to a future increase in the share price. Generally speaking, a company with more retained earnings on its balance sheet is more profitable, since higher retained earnings represents more net earnings and fewer distributions to shareholders .

A guide to small business finance

This shows you how much the company has earned in the current period. For example, if you have a high-interest loan, paying that off could generate the most savings for your business. On the other hand, if you have a loan with more lenient terms and interest rates, it might make more sense to pay that one off last if you have more immediate priorities.

Your starting balance is how many retained earnings you had from the last accounting period. Interest expenses are depending on the entity’s financing strategy. Some entities may choose to finance their operation through loans, and some entities might choose to finance through equity.

Great Southern Bancorp, Inc. Reports Preliminary First Quarter … – InvestorsObserver

Great Southern Bancorp, Inc. Reports Preliminary First Quarter ….

Posted: Wed, 19 Apr 2023 22:30:00 GMT [source]

Reinvesting profits back into the company can help it grow and become more profitable over time. The other is an action on the part of the board of directors to increase paid-in capital by reducing RE. The act of appropriation does not increase the cash available for the acquisition and is, therefore, unnecessary.

Regardless of the budgeting approach your organization adopts, it requires big data to ensure accuracy, timely execution, and of course, monitoring. Join our Sage City community to speak with business people like you. Sage 300 CRE Most widely-used construction management software in the industry.

Reliance Jio posts single-digit growth sequentially in Q4 earnings, PAT rises to ₹4,716 cr Mint – Mint

Reliance Jio posts single-digit growth sequentially in Q4 earnings, PAT rises to ₹4,716 cr Mint.

Posted: Fri, 21 Apr 2023 11:53:55 GMT [source]

Of the Company, and the nature of the business, thus affecting the profitability of the Company. – The third line represents the financial year for the retained earnings numbers that have been prepared, i.e., ‘Financial Year Ended 2018’ etc. The retained earnings calculation consists of various steps and involving different departments and stakeholders of the organization. Let us understand the step-by-step process through the discussion below. Upon combining the three line items, we arrive at the end-of-period balance – for instance, Year 0’s ending balance is $240m.

Less than what is generally called “return on shareholders’ equity.” Nevertheless, companies customarily use ROE as a principal decision criterion when considering investments and new ventures. From this perspective, retained earnings just represent deferred dividends—monies the company reinvests solely for long-term shareholder benefit. Adoption of this perspective simplifies the dividend issue with which every board of directors wrestles. In addition, use of finance and accounting software can help finance teams keep a close eye on cash flow and other critical metrics. By continually controlling spending, companies are more likely to end a fiscal period with cash on hand to use for growth. In some cases, shareholders may prefer the company reinvest rather than pay dividends despite negative tax consequences.

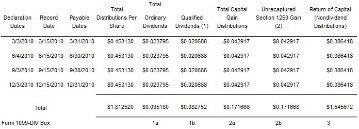

Since dividends are distributed on a per share basis, retained earnings is decreased by the total of outstanding shares multiplied by the dividend rate on each share of stock. While a board of directors may declare dividends on both common and preferred shares of stock, dividends on preferred shares of stock receive preference in order of payment. Retained earnings are the portion of income that a business keeps for internal operations rather than paying out to shareholders as dividends. Retained earnings are directly impacted by the same items that impact net income.

When calculating retained earnings, you’ll need to incorporate all forms of dividends; you’ll see that stock and cash dividends can impact the final number significantly. Retained earnings are a critical component of a company’s financial health. They represent the portion of profits that are kept within the company for future use. Retained earnings play a vital role in financing a company’s operations, funding growth initiatives, paying dividends to shareholders, and clearing loan outstandings. Investors should pay close attention to a company’s retained earnings, as they provide insights into the company’s financial health and growth prospects.

These earnings reflect the extent of a company’s ability to save net income. As a business owner, you should pay attention to retained earnings because they represent the funds your company uses for growth, to pay down your debt, or save for the future. The ending balance of retained earnings from that accounting period will now become the opening balance of retained earnings for the new accounting period. Typically, businesses invest their retained earnings back into the business to pay for projects such as research and development, better equipment, new warehouses, and fixed asset purchases.

- Some factors that will affect the retained earnings balance include expenses, sales revenues, cost of goods sold, depreciation, and more.

- On a sole proprietorship’s balance sheet and accounting equation, Owner’s Equity on one of three main components.

- The proceedings and journals on our platform are Open Access and generate millions of downloads every month.

- These articles and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”).

- Retained earnings are the portion of income that a business keeps for internal operations rather than paying out to shareholders as dividends.

- In addition to providing the company with capital for growth, retained earnings also help improve its financial ratios, such as its return on equity.

It is shown as the part of owner’s equity in the liability side of the balance sheet of the company. In effect, the equation calculates the cumulative earnings of the company post-adjustments for the distribution of any dividends to shareholders. Whether the Dow soars or plummets matters little to the companies that the shares represent. It is as if the stock market had become a giant, disembodied spirit floating unattached, with a life of its own. And yet we continue to fret over it with great seriousness, as if it meant something real. Generally accepted accounting principles provides for a standardized presentation format for a retained earnings statement.

Therefore, calculating retained earnings during an accounting period is simply the difference between net income and dividends. Is part of a company’s financial statement, which explains any change in retained earnings during an accounting period. When you notice retained earnings steadily decrease, this can be a forewarning of financial loss or even bankruptcy. For example, suppose total net income falls lower than debts and dividends.